Crypto Trading Alerts: Your Guide to Smart Trading

When it comes to cryptocurrency, having timely information can make all the difference. This is where crypto trading alerts come into play. They are essential tools for traders looking to maximize their profits and minimize their risks. Let’s dive into what these alerts are, how they work, and how you can effectively use them in your trading strategy.

Introduction to Crypto Trading Alerts

What Are Crypto Trading Alerts?

Crypto trading signals or alerts are notifications that inform traders about specific market conditions or events. These alerts can be triggered by various factors, such as price changes, volume spikes, or significant news events related to cryptocurrencies. Essentially, they act as your personal trading assistant, keeping you updated without requiring you to constantly monitor the markets.

Why Are They Important?

The crypto market is notoriously volatile. Prices can swing dramatically in a matter of minutes, making it crucial for traders to stay informed. By using crypto trading alerts, you can react quickly to market changes, ensuring that you never miss out on potential opportunities or losses.

Types of Crypto Trading Alerts

Price Alerts

Price alerts notify you when a cryptocurrency reaches a specific price point. For instance, if you want to buy Bitcoin at $30,000, you can set an alert to notify you when it hits that price. This feature is invaluable for traders who want to capitalize on price fluctuations without constantly checking their screens.

Volume Alerts

Volume alerts inform you when there is a significant change in trading volume for a particular cryptocurrency. High trading volume often indicates increased interest and can precede price movements. By setting volume alerts, you can identify potential breakout opportunities early.

News Alerts

News alerts keep you updated on significant developments in the crypto space that could impact prices. Whether it’s regulatory news, technological advancements, or market sentiment shifts, staying informed about the latest happenings is crucial for making well-informed trading decisions.

How to Set Up Crypto Trading Alerts

Choosing the Right Platform

To effectively use crypto trading alerts, selecting a reliable platform is essential. Many exchanges and trading apps offer alert features, but not all are created equal. Look for platforms that provide customizable alert options and real-time notifications.

Popular Platforms for Alerts

- Binance: Offers extensive alert customization options.

- Coinbase: User-friendly interface with basic alert features.

- TradingView: Advanced charting tools with robust alert functionalities.

Customizing Your Alerts

Once you’ve chosen a platform, it’s time to customize your alerts according to your trading strategy. You should consider factors such as:

- The cryptocurrencies you want to track.

- The specific price points or volume levels that matter to you.

- The type of notifications (email, SMS, app notifications) that suit your lifestyle best.

Benefits of Using Crypto Trading Alerts

Staying Informed in Real-Time

One of the most significant advantages of crypto trading alerts is the ability to receive real-time updates. This feature allows you to react promptly to market changes without being glued to your screen 24/7.

Making Informed Decisions

With timely information at your fingertips, you can make more informed decisions regarding your trades. Instead of relying on gut feelings or outdated information, crypto trading alerts empower you with data-driven insights.

Challenges and Limitations of Crypto Trading Alerts

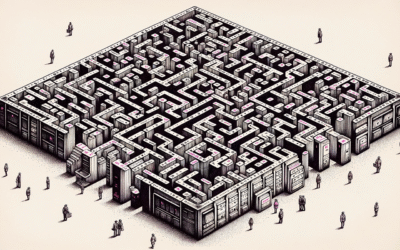

Information Overload

While alerts can be beneficial, they can also lead to information overload if not managed properly. Receiving too many notifications can be distracting and may cause you to miss critical alerts amidst the noise.

False Signals and Noise

Not every alert will lead to a profitable trade. Sometimes, market fluctuations may trigger alerts without leading to significant price movements. It’s essential to filter out noise and focus on relevant signals that align with your trading strategy.

Best Practices for Using Crypto Trading Alerts

Setting Realistic Expectations

It’s crucial to set realistic expectations when using crypto trading alerts. While they can enhance your trading strategy, they are not foolproof solutions that guarantee profits.

Combining Alerts with Other Strategies

For optimal results, consider combining crypto trading alerts with other strategies such as technical analysis or fundamental analysis. This approach will provide a more comprehensive view of the market and help refine your decision-making process.

Conclusion

In conclusion, crypto trading alerts are powerful tools that can significantly enhance your trading experience. By staying informed about market movements and trends, traders can make better decisions and potentially increase their profitability. However, it’s essential to use these alerts wisely and combine them with other strategies for maximum effectiveness.

FAQs about Crypto Trading Alerts

- What platforms offer crypto trading alerts?

Many platforms like Binance, Coinbase, and TradingView provide customizable alert features tailored for traders. - Can I set multiple types of alerts?

Yes! You can set price, volume, and news alerts simultaneously based on your preferences. - Are crypto trading alerts free?

Most exchanges offer basic alert features for free; however, some advanced functionalities may require a subscription. - How do I avoid information overload from alerts?

Customize your alert settings carefully and prioritize only the most relevant notifications based on your trading strategy. - Do crypto trading alerts guarantee profits?

While they provide valuable information, no alert system guarantees profits; they should be used as part of a broader strategy for success.

Finally, checkout PakHeadlines for more insightful news.